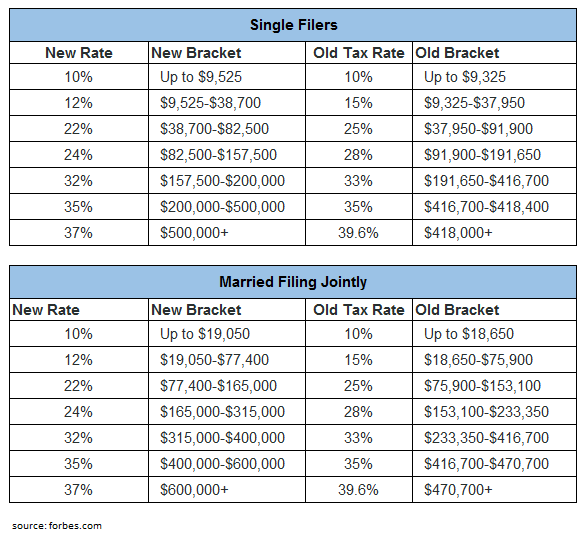

Us Tax Brackets 2025 Calculator Married Jointly. 6.20% for the employee and 6.2% for employer medicare: The top tax rate remains unchanged, staying at 37% for single taxpayers with incomes over $626,350 and $751,600 for married couples filing jointly.

Your bracket depends on your taxable income and filing status. Heads of households will have a standard deduction set at $22,500 for 2025.

2025 Tax Brackets Married Filing Jointly Calculator Becki Carolan, Estimate your income taxes by tax year.

2025 Tax Brackets For Married Filing Jointly Beginning Of Ramadan 2025, Generally, as your income increases, you’ll.

Married Filing Jointly 2025 Tax Brackets Binny Cherianne, Your bracket depends on your taxable income and filing status.

2025 Us Tax Brackets Married Filing Jointly And Gladys Mirabella, Enter your income and location to estimate your tax burden.

2025 Us Tax Brackets Married Filing Jointly And Gladys Mirabella, 2025 federal tax rate, bracket calculator.

Tax Table 2025 Married Jointly Hedy Marybelle, Calculate your federal, state and local taxes for the current filing year with our free income tax calculator.

Irs Tax Brackets 2025 Married Filing Jointly Carmel Julienne, It's important to note that these rates generally don't change unless congress passes major tax legislation.

2025 Tax Bracket Calculator Simon Hughes, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Tax Brackets 2025 For Married Filing Jointly Guinna Christye, The top marginal income tax rate of 37 percent will hit taxpayers with taxable income.