Max Tax Bracket 2025. These are the numbers that you’ll. Individual tax return form 1040 instructions;

You may be able to claim marriage allowance to reduce your partner’s tax if your income is less than the standard personal allowance. Individual tax return form 1040 instructions;

However, a taxpayer who doesn’t have a tax liability to offset may be able to qualify for the additional child tax credit of.

The information herein is general and educational in nature and should not be considered legal or tax advice.

Us federal tax brackets 2025 vaultseka, If you have been hit with a big tax bill in the past, you should talk with a tax adviser about how to reduce your next tax bill. Child tax credit (ctc) the maximum child tax credit is $2,000 per qualifying child and is not adjusted for inflation.

🚮 What Is My Tax Bracket? YouTube, In the u.s., we have a progressive tax system, so. It’s probably easier to have a little.

Enduro/AM The Weight Game Page 7471 Pinkbike Forum, 77 362 + 31% of taxable income above 370 500. Your entire income won’t necessarily be taxed at.

Tax Bracket (feat. Tony Star) YouTube, The child tax credit is not refundable. Individual tax return form 1040 instructions;

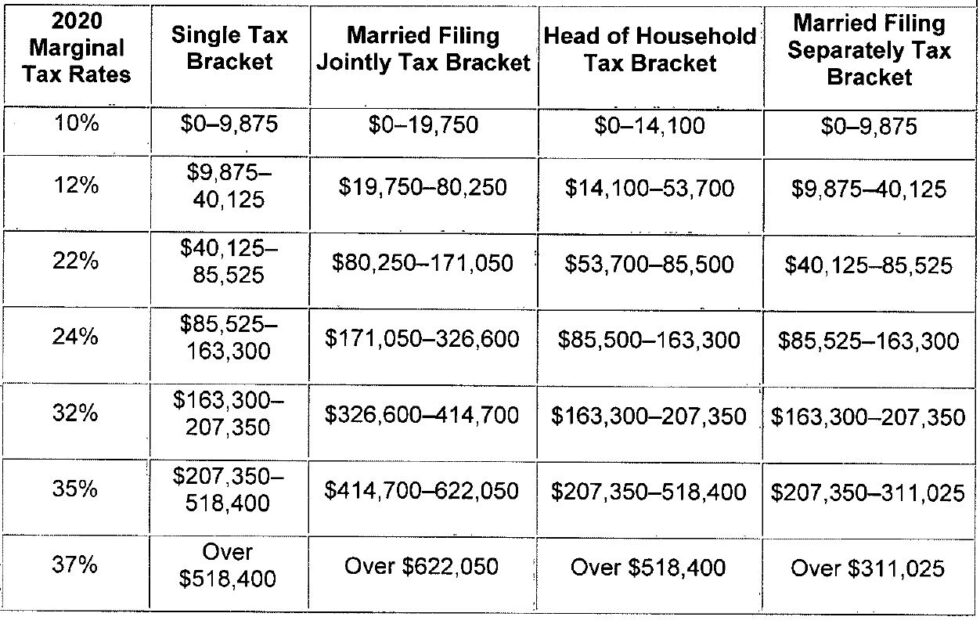

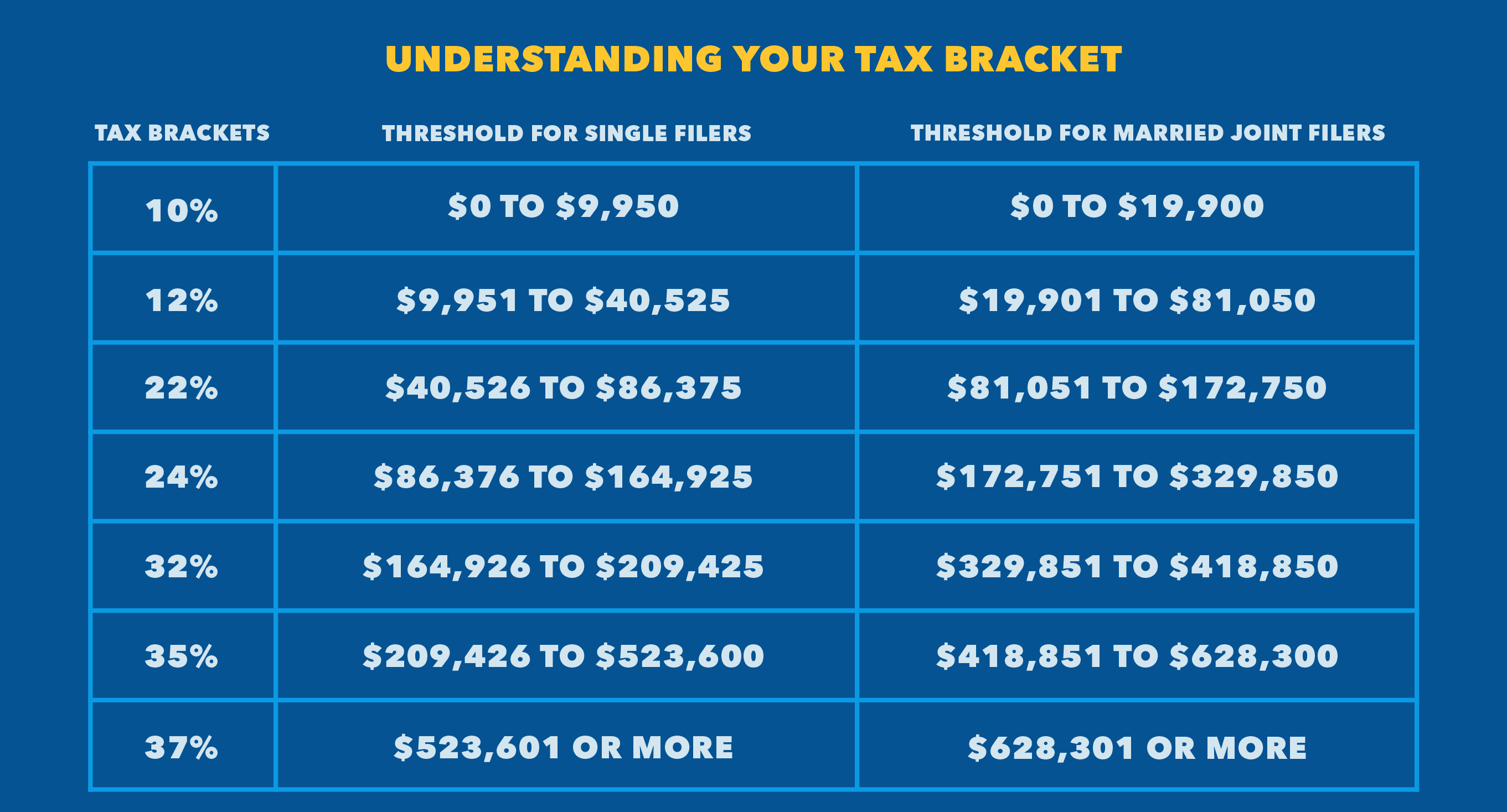

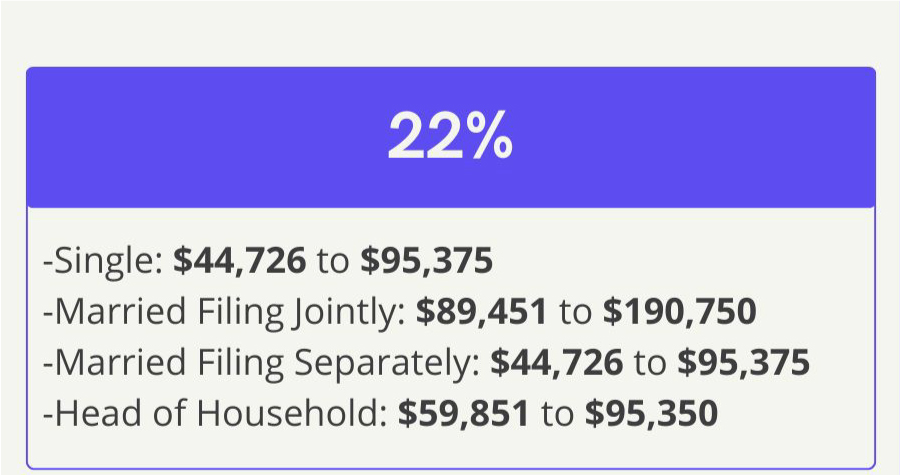

What Is My Tax Bracket for the 2025 Tax Year? — Epiphany Capital, The tax you owe could vary based on where your income comes from and how it is broken up. 121 475 + 36% of.

How to Get to the 0 Tax Bracket in Retirement YouTube, Tax preparation and filing view all tax preparation and filing tax credits and deductions tax forms tax software and products tax preparation basics nerdwallet tax filing tax. They are not the numbers that you’ll use to prepare your 2025 tax returns in 2025 (you’ll find those official 2025 tax numbers here).

Orion Planning Roth Conversion Overview, Suppose your filing status is single, and you have. Then copy the results to your tax return on form 1040 to figure your overall tax rate.

The 250 tax bracket! YouTube, Individual tax return form 1040 instructions; Child tax credit (ctc) the maximum child tax credit is $2,000 per qualifying child and is not adjusted for inflation.

What Happens When You Go Into A Higher Tax Bracket YouTube, This may help keep you in a lower tax bracket after you stop working. You may be able to claim marriage allowance to reduce your partner’s tax if your income is less than the standard personal allowance.

What's My 2025 Tax Bracket? Oklahoma Financial Center, Request for taxpayer identification number (tin) and certification form. It’s probably easier to have a little.

You may be able to claim marriage allowance to reduce your partner’s tax if your income is less than the standard personal allowance.